Global equities are set for another bumper year. The MSCI All Country World Index is up 23% in EUR in 2024 – on track for its best year calendar year since 2016 – following 15% gains in 2023[1]. Our global equity fund, SKAGEN Global has also delivered good absolute return with a rise of 14%, although performance is bitter-sweet, as Lead Portfolio Manager, Knut Gezelius, explains: “Our fund continues to deliver absolute returns above the long-term average expected from equities but 2024 has been up-and-down in relative terms, with performance impacted by being underweight large-cap information technology stocks which continue to lead the market charge.”

SKAGEN Global is not alone in this regard – recent research by Trustnet finds that almost 80% of active equity funds tracking the MSCI ACWI are lagging the benchmark this year – with every member of the Magnificent Seven in the index’s top 10 constituents[2]. “At the end of the third quarter, SKAGEN Global owned Alphabet (Google) and Microsoft but not the other five stocks, although we continuously assess candidates for the fund. We sold down Microsoft earlier this year as the valuation became stretched and that proved to be the correct decision as the company has underperformed the index. With the valuation becoming attractive once again we may look to increase our holding,” adds Gezelius.

The fund’s top three contributors this year are Brown & Brown, DSV and JP Morgan, with Dollar General, Nike and Samsung its three largest detractors. The biggest two laggards have exited the fund, but Gezelius believes that Samsung has been oversold and remains positive on the investment case: “The shares have had a challenging few weeks without any significant company news, thus offering investors a buying opportunity. We think the market has overacted to some extent but Samsung also needs to deliver to get its share price back on track.”

Portfolio positioning

There have been several portfolio changes in the first nine months of 2024 with six companies exiting the fund and six new holdings coming in. The top ten positions make up just over half of the portfolio (52% of assets) with 42% invested in financial services, its largest sector exposure. Financials has been Global’s best-performing sector this year with the holdings diversified across different sub-sectors, including insurance, credit rating agencies, stock exchanges and payment providers, and the fund owning only one bank, JP Morgan.

Gezelius is happy with the portfolio’s overall positioning: “We continue to believe that we have a strong portfolio that is significantly undervalued – we conservatively estimate the fund has 40% weighted upside over a 2–3-year investment horizon – and provides bottom-up exposure to some attractive investment themes.”

Global’s portfolio is designed to deliver attractive risk-adjusted return in a wide variety of macro and market scenarios.

Source: SKAGEN. As at 30/09/2024.

[1] As at 18 November 2024 in EUR, fund performance net of fees.

[2] Almost 70% of active equity funds fall behind the market this year, Trustnet, 18 November 2024.

Positive US outlook

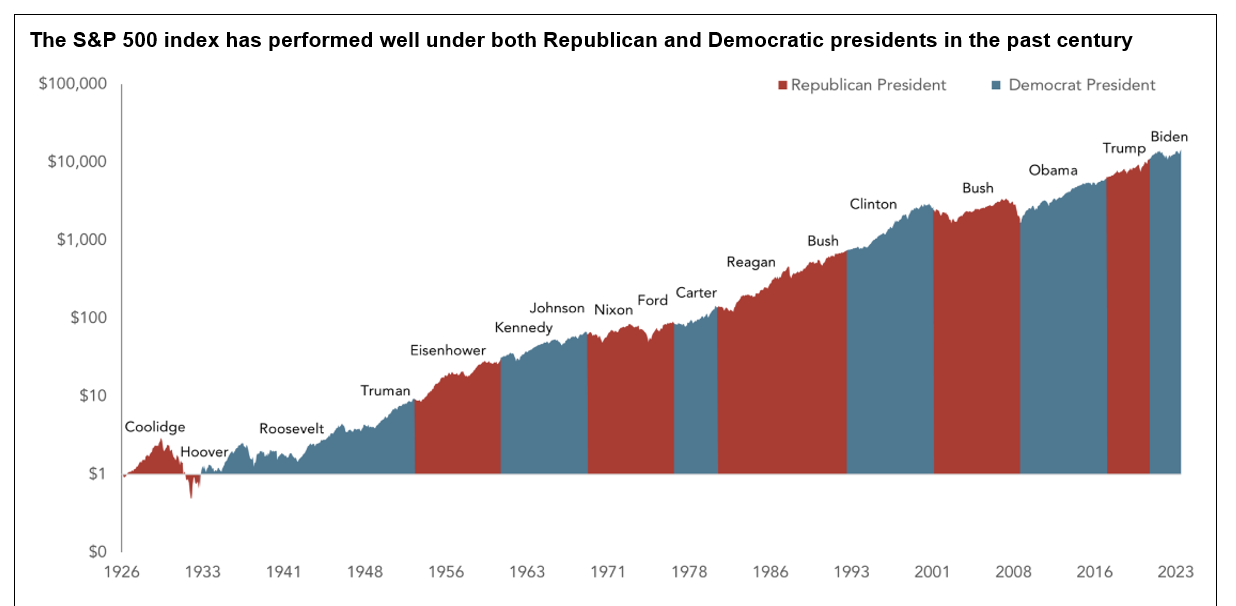

The fund’s largest country exposure is the US where 55% of assets are invested, which is less than the MSCI ACWI where the US represents 65% of market capitalisation. Recent news flow has been dominated by the election result, although Gezelius is cautious that stocks will inevitably rise under the new president: “Many commentators think that lower taxes and less regulation under a Republican should be better for the stock market, but history shows that over time US equities have performed well whoever has been in power. In 2000 George Bush was elected on a similar agenda to Trump but oversaw a negative return due to the dot com bubble and financial crisis, which shows that government policies only have so much stock market influence.”

Trying to predict which sectors will perform best under Trump looks equally futile with a similar lack of correlation historically between performance and the party in power, although Gezelius believes that three underappreciated areas of the US market could flourish under the new president: “Housing has received relatively little attention but Trump has proposed making federal land available for building new homes – we own Home Depot which is one way of playing this theme. Secondly, stock exchanges aren’t overly reliant on particular sectors and are a good way to gain exposure to the broader market. Finally, financials generally look attractive; even without banks benefitting from higher rates as a result of inflationary policies – which may or may not happen – there are strong specialty finance companies within the broader sector.”

Gezelius has a greater degree of confidence predicting that the US will continue to dominate global stock markets in the years ahead: “The US market has outperformed all other regions substantially for over twenty years and seen its share of global indices rise to the extent that currently 19 of the 20 largest companies in the MSCI AC World Index are US-listed. It’s clear that there are going to be some substantial changes under Trump, but it would be hard to bet against the US over the next four years and it will remain a good place to look for companies.”

On a final note, Gezelius adds a word of caution: “While the US market will likely continue to be a good hunting ground, investors should not forget that non-US markets also offer select attractive bottom-up opportunities that may deserve a place in a well-balanced long-term investment portfolio.”

Watch the recent webinar with Knut Gezelius:

-----

All information as at 31/10/2024 unless stated.