After a torrid March, global equities rose 13% in the final week to register a 20% decline over the first quarter. Buoyed by the US Senate sealing a $2 trillion coronavirus stimulus package and tentative signs that the worst affected European countries may be approaching peak infection levels, risk appetite appears is returning, even if the rally proves to be short-lived.

While predicting when the stock market will hit rock bottom is impossible, looking at previous crises could help to gauge the potential speed of its recovery from the coronavirus and assess how our funds might be expected to perform once momentum is gathered.

History repeating

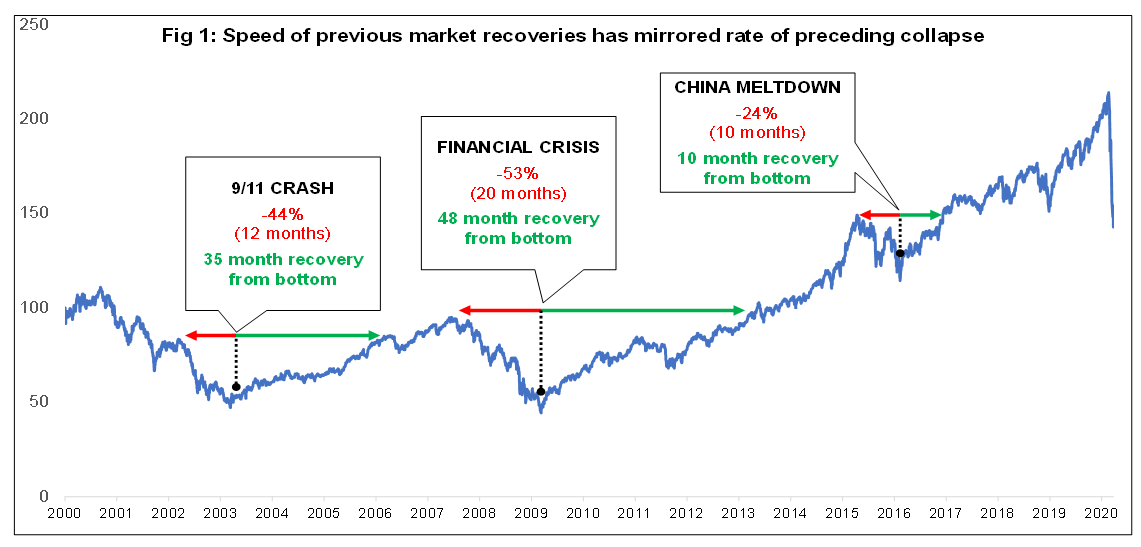

Global equities, as measured by the MSCI World Index (EUR), fell by a third between their mid-February highs and March lows. The benchmark has plunged into similar bear markets (>20%) three times in the past twenty years. First, in 2002 following the dot-com bubble, 9/11 attacks and US accounting scandals, the index fell 44% over a 12-month period. From its low point in March 2003 it took 35 months to fully recover these losses (see figure 1 below).

The market then rose until the global financial crisis brought a major sell-off with global equities losing over half their value between July 2007 and March 2009 before steadily recouping the losses over a 4-year period and continuing their ascent. Most recently, concerns over China's economy overheating caused the global index to fall by a quarter in 2015 before recovering relatively quickly and marching higher until the coronavirus outbreak.

While each of these corrections occurred for different reasons – and none similar to the coronavirus – they were all rapid once panic set in, and the subsequent recoveries usually took considerably longer. Another observation is that although the drop tends to be uneven as volatility is high – certainly true at present – once markets turn, the upward momentum is relatively smooth.

Emerging markets show broadly the same picture with movements of similar magnitude, albeit they have tended to peak slightly later before correcting, and then both falling and recovering faster. The current sell-off has seen emerging markets fall in lockstep with developed ones reflecting the global nature of the coronavirus pandemic (see figure 2).

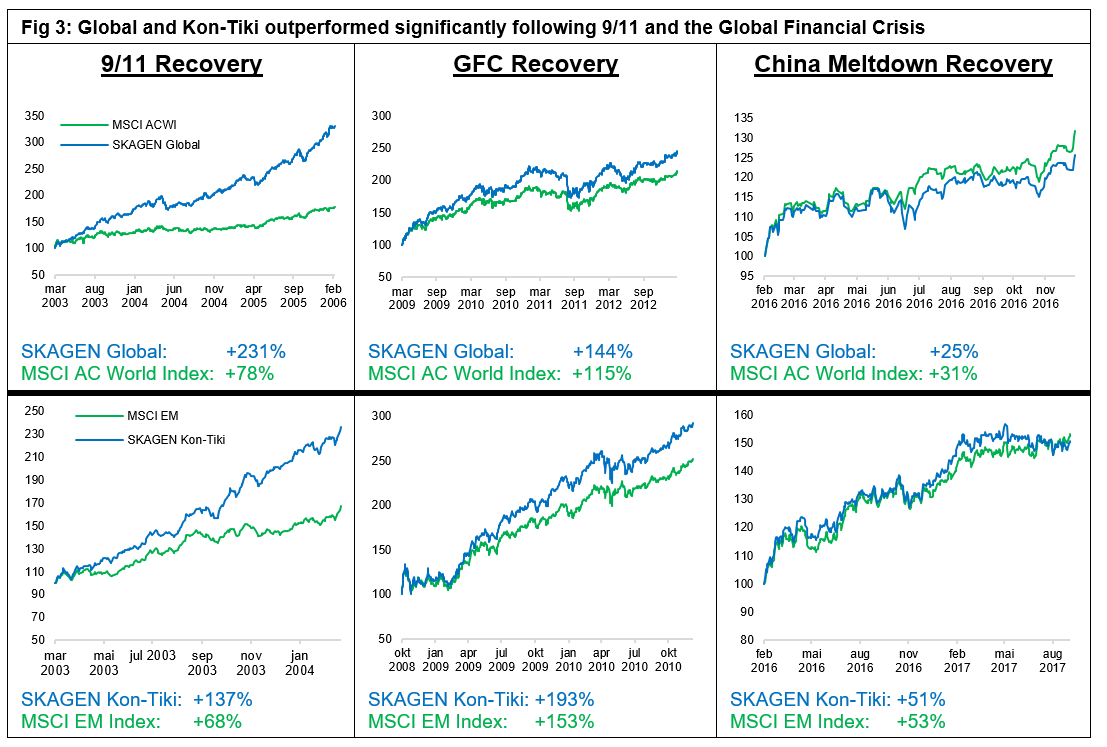

Encouraging for clients in SKAGEN is that our funds have previously tended to outperform strongly during the recovery phase (i.e. the period over which the correction losses were recouped), particularly following a significant sell-off. Looked at another way, they have generally regained losses more quickly than their respective benchmarks.

SKAGEN Global and SKAGEN Kon-Tiki beat their respective indices comfortably following the previous major corrections – 9/11 and the Global Financial Crisis – driven by good stock selection in the funds and value outperforming growth as cheaper stocks gained in popularity (see figure 3).

What will recovery look like this time?

The path to economic recovery from the coronavirus is clearly impossible to predict as a result of its unprecedented nature and that it is a rapidly changing situation. What we do know so far is that the economic impact has been brutal with PMI data (particularly services) falling sharply and unemployment figures spiking in countries put into lock-down. The better news is that in China PMI figures recovered sharply once black-outs were lifted, suggesting a V-shaped recovery might be possible. Central banks have also responded faster and with greater stimulus than ever before.

We also know from previous crashes that equity markets usually turn before economies do, but forecasting when and how quickly stock markets will recover this time round is equally difficult to call. As shown above, bear markets tend to occur in stages meaning that long-term revivals rarely happen following a single shock. Equities generally remain highly valued, particularly in the US, while company guidance and earnings will inevitably fall until the economic outlook becomes clearer.

However, looking even further back to the turn of the previous century underlines how stock markets spend most of their time climbing slowly, punctuated by sharp corrections of differing magnitudes. Based on over a century of data, while the current correction is perhaps the most painful – undeniably so in terms of the human cost – it will inevitably turn and the market's upward trajectory will again continue.

NB: All performance figures in EUR (SKAGEN figures net of fees)