At the fore of SKAGEN's ESG policy since it was introduced in 2002 has been corporate governance. We typically only invest in companies with strong existing frameworks for protecting minority shareholders or those demonstrating clear evidence of improving governance to unlock shareholder value.

All investments involve risk and it is the job of our fund managers to find companies which offer the best risk-adjusted returns for clients. While risk is often measured using financial ratios or credit ratings, these often focus on debt and threats can come from a variety of internal and external factors.

We regularly engage with our holdings on these in order to understand our own risk exposure and to encourage companies to act in a way that minimises the threats they face or may pose to areas like the environment, employees or society in general. SKAGEN reinforces our active ownership by voting at general meetings and will vote against management if we have concerns to influence them in a more sustainable direction.

Occasionally, however, management teams act negligently or in their own interests rather than those of shareholders. If this happens, our only option as investors is to use legal proceedings, particularly if management's action (or inaction) has caused financial loss to us and our clients. Under the Norwegian Securities Fund Act, SKAGEN has a duty to safeguard the interest of unit holders and the integrity of the market in the best possible manner (see Section 2-15).

Class actions

Most of SKAGEN's legal engagement is via class actions when we join other investors in litigation against companies which have acted illegally. We use law firm KesslerTopazMetzlerCheck (KTMC) who monitor securities fraud, corporate mismanagement and other fiduciary and shareholder cases that we may be able to join. KTMC operates on a fully contingent basis, meaning that it covers all legal costs and receives a proportion of the settlement or damages in return – no win, no fee, in other words.

The class actions that SKAGEN joins fall into two categories. The first is cases that have been resolved and we then seek our pro-rata share of the settlement or award on behalf of clients. In other cases, SKAGEN acts as the lead plaintiff in seeking financial compensation which will then be shared with other investors who join the lawsuit. To date we have recovered over USD 6.8 million on behalf of clients from class actions and currently have several proceedings ongoing.

Direct litigation

Alternatively, SKAGEN will sometimes decide to opt out of a class action in order to pursue the claim in direct litigation. This is normally done when the case is stronger and/or the financial damages sought are larger.

In 2015 we successfully sued Petrobras after the Brazilian state-owned energy company's value fell in the wake of corruption allegations. Management not only ignored internal red flags, but was found to have actively taken bribes in one of the world's biggest corruption scandals. SKAGEN was able to recover significant compensation for clients from the wrongdoing which saw many directors and politicians jailed. With a total settlement value of $3,000 million, Petrobras ranks as the fifth largest class action settlement of all time and the largest ever in the energy sector[1].

Governance incentive

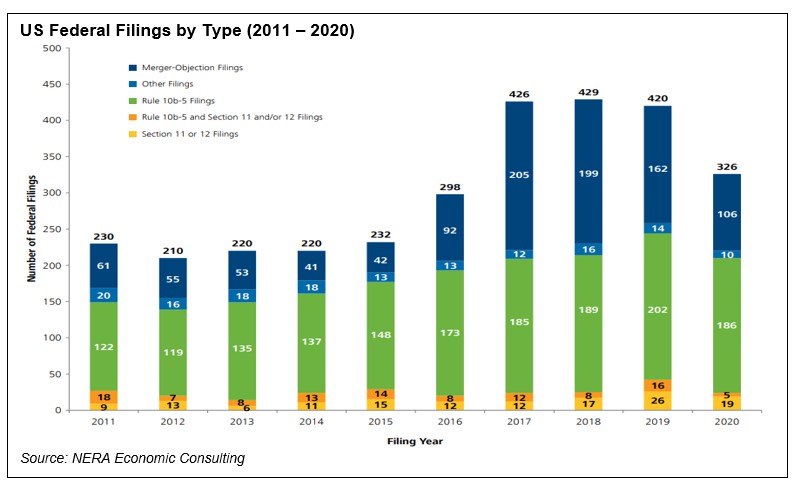

The threat of legal proceedings is useful to ensure that companies act in the best interests of minority shareholders and uphold good standards of corporate governance, particularly as Board directors can now also be personally liable for any breach of their fiduciary responsibilities. Litigation has steadily increased over time as financing has become easier to access and settlement values have remained high (the average US pay-out was $44 million in 2020¹).

At SKAGEN, we will continue to conduct strict due diligence on all new investments and ongoing risk assessment on behalf of clients. We will also engage with companies – both individually and in collaboration with other investors – to encourage management to adopt best practices and sustainable behaviour.

However, for companies acting unreasonably or unlawfully – accounting issues, missed guidance, misled future performance and regulatory issues make up almost all US shareholder class actions¹ – even the most detailed analysis can only go so far. In such cases we will continue to seek legal remedy; as well as providing reassurance to clients we believe this is important for raising governance standards in our holdings and companies generally.

[1] Source: NERA Economic Consulting, 2020 Full-Year Review, January 2021